Cost-push inflation happens when prices go up because it costs more to make things. In this type of inflation, it’s not about people wanting more, but the cost of making stuff becomes the big deal. Once it starts in one industry, it tends to spread to all others in an economy.

The main reasons for cost-push inflation are:

- Higher Wages: When workers demand higher pay, producers often raise prices to cover the extra cost. This can create a cycle where higher prices lead to higher living costs, and then workers demand even more wages.

- Bigger Profit Margins: Producers might charge more for their goods to make bigger profits.

- Increased Taxes: Sometimes, the government increases taxes on things, and producers raise prices to make up for it.

- Less Basic Materials: If there’s not enough raw material, the cost to get it goes up, making the production cost more.

- Government Setting Higher Input Prices: If the government increases the prices of materials needed to make things, it can lead to a general rise in prices.

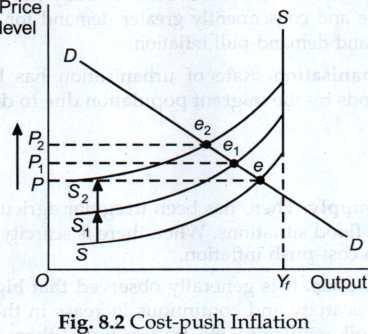

Cost-push inflation is graphically illustrated in Fig. 8.2.

where,

DD = The aggregate demand curve is given by DD.

SS, S,S, S2S = There is a fall in aggregate supply due to rise in cost of production, which is shown by leftward shift of the aggregate supply curve from SS to S,S and then to S2S.

There are no changes in the vertical portion of supply curve at full employment level.

OP, OP1, OP2 = Equilibrium price is given by intersection of demand and supply curves.Equilibrium price rises from OP to OP1 and then to OP2 due to decrease in aggregate supply. This rise in price shows cost-push inflation.

8.4 CAUSES OF INFLATION

Fig. 8.3 gives list of factors leading to inflation in India.

| Causes of Inflation | |||||||

| Demand Factors1. Growth of population2. Rise in employment and income3. Increasing pace of urbanisation | Supply Factors1. Irregular agricultural Supply2. Hoarding of essential goods3. Rise in administered prices4. Inadequate growth of industrial production5. Agricultural price policy6. Rising prices of imports | Monetary and Fiscal Factors1. Rising levels of government expenditure2. Deficit financing | |||||

Fig. 8.3 Factors Leading to Inflation in India

8.4.1 Demand Factors

- More People: When the number of people keeps growing, like 18 to 19 million more every year, there’s a constant need for more food and stuff. Because of this, there’s a big difference between what people want and what’s available, and that causes prices to go up, leading to demand-pull inflation.

- More Jobs and Money: More people are finding jobs, so they’re making more money. With more money, they want more things. This leads to prices going up steadily, causing demand-pull inflation.

- More People Moving to Cities: More and more people are moving to cities. When people see the cool stuff in cities, they want the same things. This makes them buy more, increasing the demand for better things, and that’s another reason for demand-pull inflation.

8.4.2 Supply Factors

- Not Enough Farm Stuff: Sometimes, things don’t go well for farming because of things like droughts or floods. When there’s not enough farm stuff, like crops, their prices go up, causing cost-push inflation.

- Keeping Stuff Away: Some big farmers and traders keep a lot of essential things, like food, in storage. When they do this, there’s less of it available, and the prices keep going up. This also happens with things like oil and medicine, where traders keep them away, causing cost-push inflation.

- Government-Controlled Prices: The government decides the prices of some important farm things. Sometimes, they raise these prices to cover the losses in the public sector. This leads to cost-push inflation.

- Not Enough Stuff from Factories: There’s a lot of money going around, and people want to buy things from factories. But the factories aren’t making enough, so the prices of things from factories go up. This is another reason for cost-push inflation.

- Farmers and Price Policy: The government has a policy that sets a minimum price for farm things. This policy helps farmers, especially the big ones, who push the government to raise these prices. This results in cost-push inflation.

- Stuff from Other Places Getting More Expensive: In the last few decades, India hasn’t been letting a lot of things come in from other countries. When the prices of things we import, like raw materials and machines, go up, it makes the cost of making things here go up too. This leads to cost-push inflation.

8.4.3 Monetary and Fiscal Factors

- More Government Spending: The government has been spending a lot more money since 1950-51. This spending has gone up because there are more people, and the country is making more money and providing more jobs. It’s about 40% of our national income, and almost 40% of that spending is on things that don’t help the country grow. This has caused demand-pull inflation.

- Spending More Than Earning: Sometimes, the government spends more money than it earns. This is called deficit financing. A little bit of this is okay to help the country grow, but if it’s a lot, it can lead to demand-pull inflation.

Objective Type Questions

1.What characterizes Cost-push inflation?

a) Higher demand for goods

b) Increase in production

c) Rising prices due to increased production costs

d) Decreased wages

Answer: c) Rising prices due to increased production costs

2.What is one reason for Cost-push inflation mentioned in the passage?

a) Decreased taxes

b) Bigger profit margins for producers

c) Reduced government spending

d) Lower wages demanded by workers

Answer: b) Bigger profit margins for producers

3.How does Higher Wages contribute to Cost-push inflation?

a) It decreases production costs

b) It leads to lower living costs

c) Producers raise prices to cover the extra cost, creating a cycle

d) It has no impact on inflation

Answer: c) Producers raise prices to cover the extra cost, creating a cycle

4.What is a Supply Factor contributing to Cost-push inflation?

a) More people moving to cities

b) Not enough farm stuff, like crops

c) More jobs and money

d) More people in the country

Answer: b) Not enough farm stuff, like crops

5.How does Government-Controlled Prices contribute to Cost-push inflation?

a) It decreases the prices of farm things

b) It helps farmers by keeping prices stable

c) The government raises prices to cover losses in the public sector

d) It has no impact on inflation

Answer: c) The government raises prices to cover losses in the public sector

6.What is a Demand Factor leading to Demand-pull inflation?

a) More people moving to cities

b) Not enough farm stuff, like crops

c) More jobs and money

d) Keeping essential things in storage

Answer: c) More jobs and money

7.How does Farmers and Price Policy contribute to Cost-push inflation?

a) It helps keep prices stable for farm things

b) The government lowers the minimum price for farm things

c) Farmers push the government to lower prices

d) The government raises minimum prices for farm things

Answer: d) The government raises minimum prices for farm things

8.What is a Monetary and Fiscal Factor leading to Demand-pull inflation?

a) More government spending

b) Deficit financing by the government

c) Reduced national income

d) Lower job opportunities

Answer: a) More government spending

9.What is the consequence of Keeping Stuff Away, as mentioned in the passage?

a) Increased availability of essential goods

b) Lower demand for goods

c) Prices keep going up due to reduced availability

d) Increased production

Answer: c) Prices keep going up due to reduced availability

10.What happens when the government spends more money than it earns, as per the passage?

a) Reduced national income

b) Decreased demand-pull inflation

c) Deficit financing, leading to demand-pull inflation

d) Increased production

Answer: c) Deficit financing, leading to demand-pull inflation

11.Why does More Government Spending contribute to Demand-pull inflation?

a) It decreases demand for goods

b) It increases the national income

c) It leads to deficit financing

d) More people have money to spend, raising demand for goods

Answer: d) More people have money to spend, raising demand for goods

12.What does the passage suggest about the impact of More People moving to cities on inflation?

a) It has no impact on inflation

b) It contributes to cost-push inflation

c) It leads to decreased demand for goods

d) It contributes to demand-pull inflation

Answer: d) It contributes to demand-pull inflation

13.Why does Increased Taxes contribute to Cost-push inflation?

a) It decreases production costs

b) It leads to reduced demand for goods

c) Producers raise prices to compensate for increased taxes

d) It has no impact on inflation

Answer: c) Producers raise prices to compensate for increased taxes

14.How does Less Basic Materials contribute to Cost-push inflation?

a) It decreases production costs

b) It leads to increased production

c) The cost to obtain materials goes up, making production cost more

d) It has no impact on inflation

Answer: c) The cost to obtain materials goes up, making production cost more

15.What is the consequence of More People, according to the passage?

a) Decreased demand for goods

b) Increased demand for goods, leading to demand-pull inflation

c) Reduced production costs

d) Lower profit margins for producers

Answer: b) Increased demand for goods, leading to demand-pull inflation